Tariffs Twitter - Unpacking The Impact

It feels like talk about trade rules and taxes on things we bring in from other places, known as tariffs, is almost always floating around, especially when we look at online conversations. You know, these kinds of discussions, so, they often pop up on social media, sparking all sorts of opinions and questions. We hear about how these taxes might change what we buy, where it comes from, and even what things cost us in the stores. This really matters because it touches so many parts of our daily lives, from the stuff we pick up at the grocery store to the materials used to build our homes.

People are naturally curious about how these big economic decisions affect them directly, and that's why these discussions get so much traction. When a country decides to put a charge on goods coming in, it sets off a chain reaction, and that chain reaction can be felt by ordinary folks. It’s not just about big businesses or government policies; it is about how much money you spend on everyday items, or how a company might have to switch where they get their supplies.

So, it’s not surprising that when something like tariffs comes up, folks head to places like Twitter to share their thoughts, ask questions, and try to make sense of it all. It becomes a place where people try to figure out the real-world consequences of these trade actions. This article will look at some specific examples of how tariffs have played out, particularly focusing on what happens when these trade measures are put into place and how they might show up in conversations around *tariffs twitter*.

Table of Contents

- What Do Tariffs Do to a Country's Money Value?

- How Did Tariffs Impact US Businesses and Tariffs Twitter?

- Shifting Supply Lines and the Tariffs Twitter Discussion

- Tariffs on Specific Materials and the Tariffs Twitter Chatter

- A Look at the Stages of Tariffs and Tariffs Twitter

- What About Tariffs on Homebuilding Goods and Tariffs Twitter?

- The Financial Burden on Everyday Folks and Tariffs Twitter

- How Did Other Nations Respond and Tariffs Twitter?

What Do Tariffs Do to a Country's Money Value?

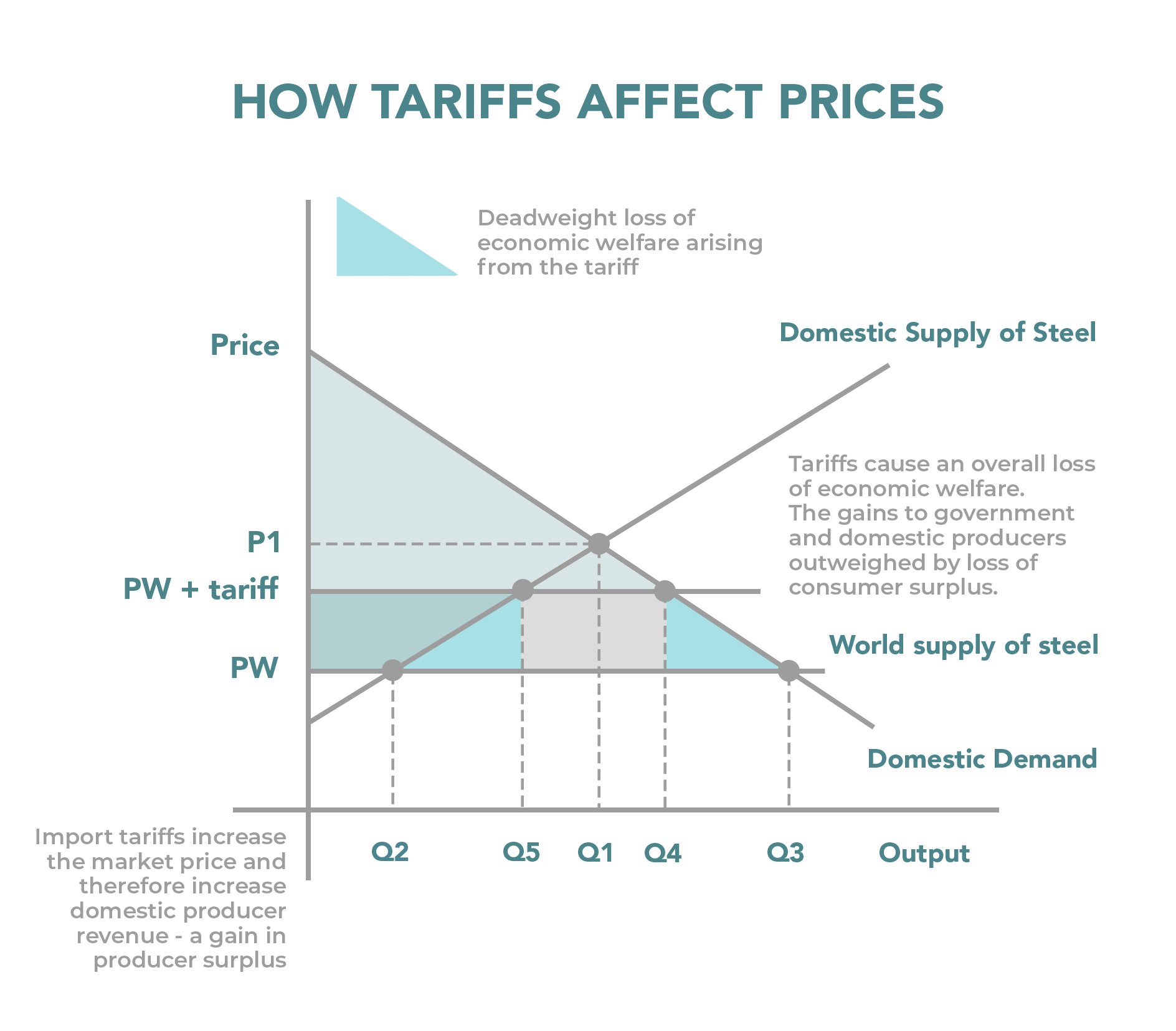

When a nation decides to put higher taxes on things coming in, like certain goods or raw materials, it usually has an interesting effect on its own currency. It tends to make that country's money worth more compared to other currencies. This might sound good at first glance, but it can actually lead to some tricky situations, especially for businesses that sell things to other countries. For instance, if the value of a country's money goes up, then its products become more expensive for people in other nations to purchase. This is just a little something that happens when these kinds of trade rules are put in place.

Think about it this way: if you're trying to sell something abroad, and the money you want to be paid in is suddenly much stronger, then your product will seem pricier to someone using a different kind of money. This can make your goods less appealing to buyers outside your country. As a result, people looking for a good deal might start to look elsewhere, searching for things that are more affordable. This shift in buying habits can, in turn, lead to a drop in how much a country exports, which means selling fewer items to other places. It’s a bit of a ripple effect, you know, and it shows how interconnected global commerce truly is.

This sort of economic change can certainly spark conversations among people who follow business news or who are simply trying to make sense of why certain products are priced the way they are. You might see folks on *tariffs twitter* discussing how their favorite imported items suddenly cost more, or how local businesses that rely on selling things overseas are feeling the pinch. It’s a topic that really gets people thinking about the bigger picture of how money moves around the world and how government actions can influence those movements.

How Did Tariffs Impact US Businesses and Tariffs Twitter?

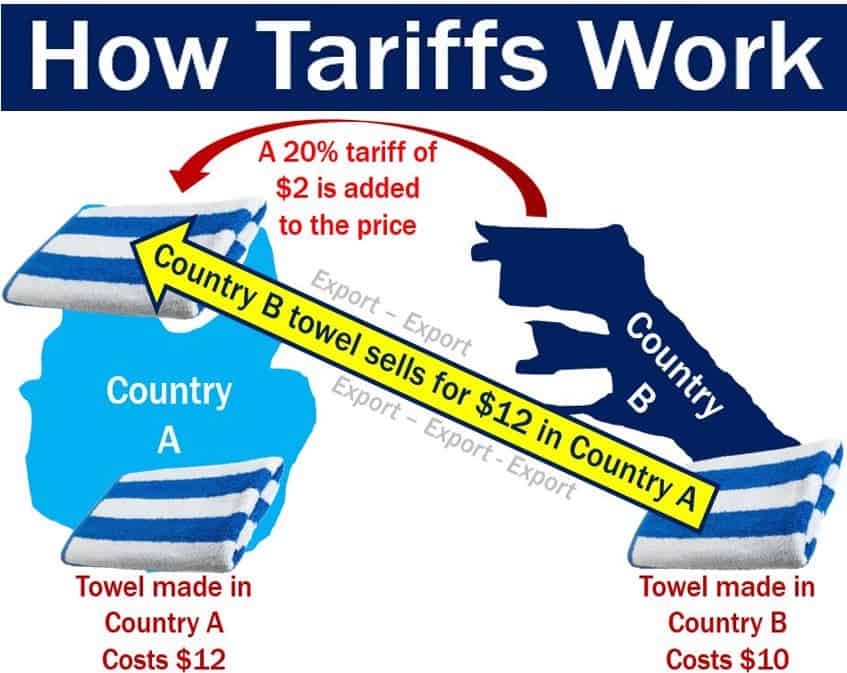

The imposition of these trade charges has brought about a noticeable change for the worse in the United States. Many businesses, from small operations to larger companies, have felt the squeeze. It's not just a minor inconvenience; the effects have been quite significant, impacting various aspects of how these businesses operate and how much they spend. For example, if a company relies on bringing in certain components from another country, and those components suddenly have an added tax on them, the cost of making their own products goes up. This can make it harder for them to keep their prices competitive, or they might have to pass those extra costs along to the people who buy their goods.

We've seen how these measures have created a tougher environment for many American enterprises. The idea was, perhaps, to encourage buying things made at home, but the reality for many has been an increase in their expenses. This can lead to some tough choices for business owners, like whether to absorb the costs, raise prices, or even look for new places to get their supplies. It’s a complex situation, and it really shows how decisions made at a high level can trickle down and affect the everyday operations of companies and, ultimately, the pockets of consumers.

This whole situation naturally becomes a hot topic for discussion, and you can often find people sharing their experiences and concerns on platforms like *tariffs twitter*. Business owners might share stories of how their profit margins are shrinking, or how they're struggling to find alternative suppliers. Consumers, too, might chime in, wondering why the price of certain items has gone up. It’s a very real-world impact that gets a lot of attention because it touches so many different people and their livelihoods, you know.

Shifting Supply Lines and the Tariffs Twitter Discussion

Some investigations into the effects of these trade taxes have revealed an interesting trend: companies that bring in goods started to look away from China. It seems they began to change how they get their products, finding new ways to organize their supply networks. This means instead of getting parts or finished items from one place, they started to explore other countries or even tried to find sources closer to home. This kind of big shift in where businesses get their stuff is a pretty big deal, actually, because it involves a lot of planning and effort to make those changes happen.

Imagine a business that has been getting a particular component from a supplier in China for years. Suddenly, with new taxes on those items, it becomes much more expensive. So, they have to go out and find a new supplier, perhaps in Vietnam, Mexico, or even within the United States. This isn't a simple task; it involves finding new partners, checking the quality of their products, and figuring out all the logistics of shipping and delivery from a different location. It's a whole lot of work to basically redraw their maps for where things come from, you know, and it can take quite a bit of time to get it all sorted out.

These changes in how global supply chains are set up are a frequent point of conversation, especially on platforms where people discuss economic trends. You might see people on *tariffs twitter* talking about how certain products are now "made elsewhere" or how companies are announcing new factories in different parts of the world. It’s a visible sign of how these trade rules can reshape the very fabric of international commerce, pushing businesses to adapt and find new ways to operate in a changing global landscape.

Tariffs on Specific Materials and the Tariffs Twitter Chatter

There was a period when the leader of the country, President Trump, put special taxes only on aluminum that the United States bought. This is a pretty important detail because it meant these particular taxes would not have any influence on the overall market rates for aluminum around the globe. The prices set on the London Metal Exchange, for instance, would remain unaffected by these specific American charges. This is because the tariffs were applied only to what was coming into one nation, rather than being a worldwide rule for everyone buying aluminum.

So, if a company in Germany was buying aluminum, they wouldn't see their costs go up because of the tariffs that the United States had put in place. These were, in a way, very targeted measures, meant to impact only the flow of this metal into the American market. It highlights how some trade actions can be quite specific in their reach, aiming to change things within one country's borders without necessarily sending ripples across all international markets for that item. It's a subtle but significant difference, really.

This specific application of tariffs can lead to some interesting discussions among people who follow trade news or industry trends. On *tariffs twitter*, you might find people debating whether such targeted measures are effective, or if they just shift the burden around without truly changing the global picture. It’s a nuanced point that often sparks a lot of back-and-forth about the true impact of these kinds of economic tools.

A Look at the Stages of Tariffs and Tariffs Twitter

During the year 2018, the administration led by President Trump put in place a series of these trade taxes, in four separate steps. These steps were given names like "lists 1, 2, 3, and 4a," and they were all applied to things brought in from China. It wasn't just one big announcement; it was a gradual rollout, with different goods being hit with these charges at different times throughout that year. This kind of phased approach means that businesses and consumers had to keep up with new rules as they came out, which could be a bit of a challenge, you know.

Imagine trying to run a business that relies on imports, and every few months, a new set of taxes is added to different items you need. It requires constant adjustment and careful planning to figure out how these new costs will affect your operations. Each "list" brought a fresh wave of items that would now be more expensive to bring into the country. This gradual application of tariffs is a strategic choice, perhaps to give businesses some time to adjust, or to escalate pressure over time.

The unfolding of these different stages certainly generated a lot of conversation and analysis. On *tariffs twitter*, you could probably see people reacting to each new list as it was announced, discussing which products would be affected next and what that might mean for prices or availability. It creates a sense of ongoing change and adaptation within the global trading system, and it keeps people talking about the implications for various industries and for their own wallets.

What About Tariffs on Homebuilding Goods and Tariffs Twitter?

Among the many items that faced these new trade taxes, some particular ones were looked at in a study. These specific tariffs were on goods that are used in building homes, and they came from what was known as "list 3." So, this means that things like certain types of lumber, pipes, or other materials that go into constructing houses might have had an extra cost added to them when brought into the country. This is a very direct link to something that affects many people, as housing costs are a big part of most family budgets.

When the cost of materials used to build homes goes up, it can have a ripple effect on the housing market. Builders might find it more expensive to put up new houses, which could, in turn, lead to higher prices for new homes. Or, if they're doing renovations, the cost of those projects could also increase. This can make it harder for people to afford to buy a new place or to make improvements to their existing one. It's a tangible way that these broader economic policies can touch individual households and their financial plans.

Conversations about the cost of housing are always happening, and when tariffs on building materials are involved, it adds another layer to that discussion. You can bet that on *tariffs twitter*, people involved in construction, or those simply trying to buy a home, might be sharing their frustrations or observations about how these specific taxes are impacting their ability to build or buy. It's a very practical concern that resonates with many people because shelter is such a basic need, after all.

The Financial Burden on Everyday Folks and Tariffs Twitter

Since the year 2018, these trade taxes have meant that people in America have paid an extra amount, adding up to a truly large sum of money – about $195 billion. This isn't just a number on a spreadsheet; it represents real money that has come out of the pockets of everyday individuals and families. It's the cumulative effect of all those slightly higher prices on imported goods, or the increased costs that businesses passed on to their customers. This is, in a way, a significant financial burden that has been placed upon the public.

Think about all the different things we buy that might have some imported component or might be affected by these trade rules. From electronics to clothing, from certain foods to parts for our cars, these added costs can add up over time. It means that the money people earn simply doesn't go as far as it used to for certain purchases. This kind of financial impact can be felt in household budgets across the country, making it harder for some to save or to afford the things they need or want. It's a very real economic consequence, you know.

When people feel these kinds of financial pressures, they often look for answers or places to share their experiences. It's quite common to see discussions on *tariffs twitter* where people express their concerns about rising prices, or debate who is truly bearing the cost of these trade policies. The sheer scale of the $195 billion figure makes it a topic that captures attention and fuels a lot of conversation about economic fairness and the impact of government decisions on personal finances.

How Did Other Nations Respond and Tariffs Twitter?

When the United States put these trade taxes on goods from China, China did something in return. They reacted by putting their own similar taxes on things coming from the United States. This is a pretty common pattern in international trade disputes; when one country imposes tariffs, the other often responds with its own set of charges. It's a kind of tit-for-tat situation that can escalate, making it harder for businesses in both countries to sell their products to the other. This kind of back-and-forth is something that really shapes how global commerce operates.

So, if an American farmer was trying to sell soybeans to China, those soybeans might suddenly have an extra tax on them, making them more expensive for Chinese buyers. This could make it harder for the farmer to sell their produce, or they might have to lower their prices, which would reduce their earnings. It’s a direct consequence of these retaliatory measures, and it shows how complex and interconnected the world's economies are. These actions can affect specific industries and the livelihoods of many people involved in those industries, you know.

Beyond the specific example of China, the leader of the country, President Trump, also put similar taxes on steel. This means that steel brought into the United States also faced an additional charge. These kinds of broad tariffs on key materials can affect many different industries that rely on steel, from car manufacturing to construction. It’s another example of how these trade policies can spread their influence across various sectors of the economy, creating new challenges and requiring businesses to adjust their strategies.

The responses from other nations and the broader application of these trade taxes are certainly topics that generate a lot of discussion. On *tariffs twitter*, you might find people debating the effectiveness of these retaliatory measures, or sharing news about how different industries are coping with the new trade environment. It's a constant stream of information and opinion as people try to make sense of these complex global interactions and their effects on everyday life and business.

To sum up, the discussions around *tariffs twitter* highlight how trade taxes on items like oil, gas, aluminum, and homebuilding goods have led to shifts in currency value, changed how businesses get their supplies, and cost American consumers a significant amount. We've seen how these taxes were introduced in stages, how other countries responded with their own charges, and how specific materials like steel were also affected. The impact on prices and the reorganization of supply chains are central to understanding these trade measures.

Detail Author:

- Name : Miss Noemie Fay MD

- Username : shanna54

- Email : franecki.jettie@hotmail.com

- Birthdate : 1991-02-15

- Address : 643 Turner Glen Wizachester, WA 59923

- Phone : +1-781-723-9200

- Company : Frami-Wunsch

- Job : Construction Laborer

- Bio : Consequuntur ea magni totam voluptatem reprehenderit. Autem omnis doloremque dolorem aut. Ipsam voluptatem culpa vero recusandae ut aperiam rerum.

Socials

instagram:

- url : https://instagram.com/shayleebeier

- username : shayleebeier

- bio : Accusamus at illum ullam quisquam. Quaerat reprehenderit voluptatibus sapiente dolorum.

- followers : 2261

- following : 1126

linkedin:

- url : https://linkedin.com/in/shaylee8262

- username : shaylee8262

- bio : Dolor distinctio id non vitae accusantium enim.

- followers : 2794

- following : 2898

tiktok:

- url : https://tiktok.com/@shaylee_id

- username : shaylee_id

- bio : Facere aut consequatur eos voluptas autem assumenda dolorem est.

- followers : 983

- following : 620